Top Guidelines Of Investment Representative

Wiki Article

Independent Financial Advisor Canada Can Be Fun For Everyone

Table of ContentsNot known Details About Lighthouse Wealth Management The Best Strategy To Use For Financial Advisor Victoria BcA Biased View of Investment ConsultantFinancial Advisor Victoria Bc for BeginnersGetting The Independent Financial Advisor Canada To WorkThe Best Guide To Financial Advisor Victoria Bc

“If you're purchase a product or service, state a television or a pc, you'd would like to know the specifications of itwhat are its parts and what it can perform,” Purda explains. “You can remember getting financial information and assistance in the same way. Folks need to find out what they are buying.” With financial advice, it's vital that you understand that the item is not ties, shares or other opportunities.it is things such as cost management, planning for pension or reducing personal debt. And like purchasing a personal computer from a dependable company, customers wish to know they have been getting financial advice from a dependable professional. Certainly Purda and Ashworth’s most fascinating findings is just about the charges that financial planners charge their clients.

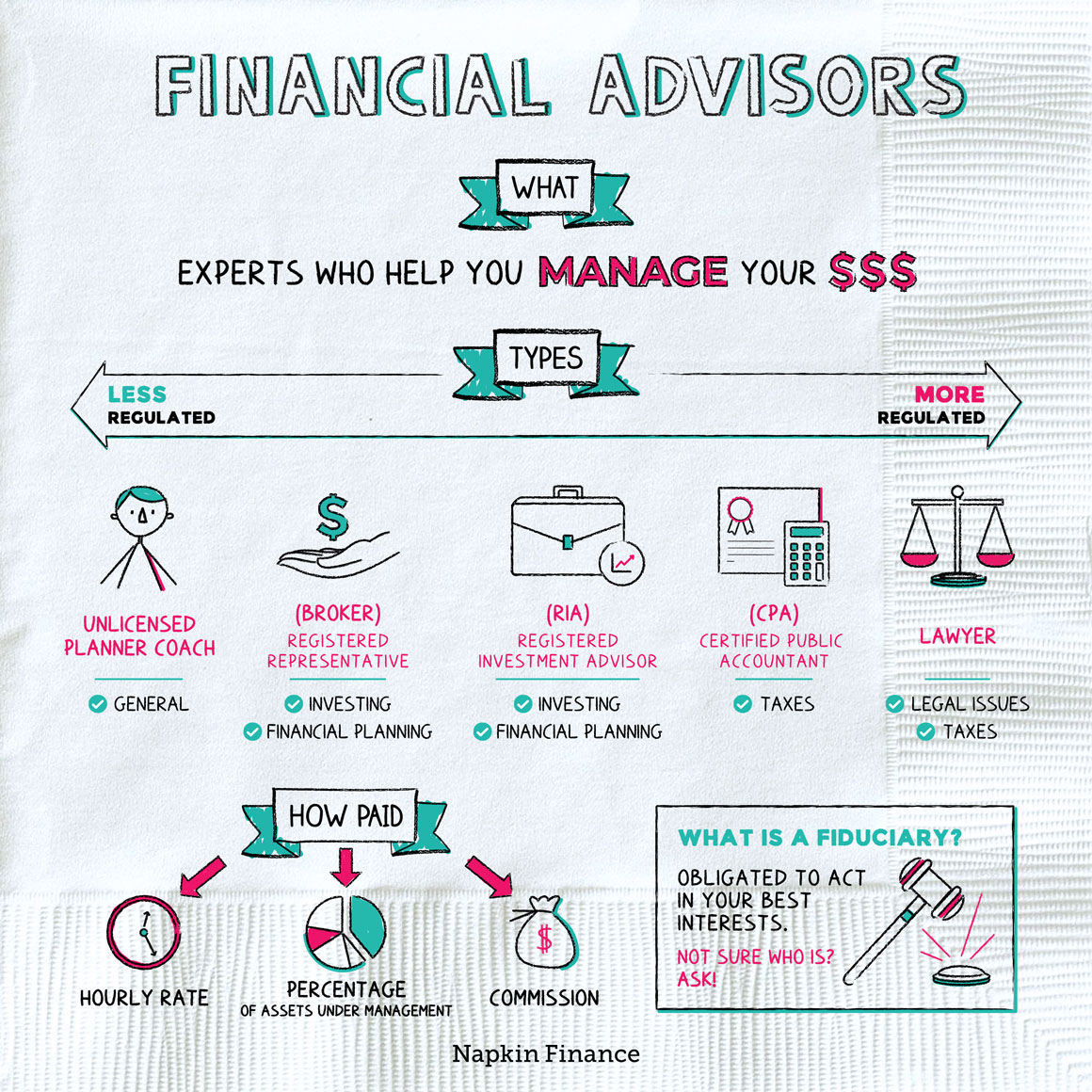

This presented genuine irrespective of the cost structurehourly, payment, possessions under administration or predetermined fee (in the learn, the buck value of charges ended up being the exact same in each instance). “It nonetheless comes down to the value proposal and anxiety on customers’ part which they don’t know very well what these are typically getting back in exchange for those costs,” states Purda.

The Ultimate Guide To Independent Investment Advisor Canada

Tune in to this particular article as soon as you listen to the definition of monetary advisor, just what comes to mind? A lot of people remember a professional who is able to provide them with monetary information, particularly when considering trading. That’s the place to begin, however it doesn’t decorate the picture. Not really close! Economic experts often helps individuals with a lot of different money objectives also.

An economic consultant assists you to develop wide range and shield it for any long-term. They may be able calculate your personal future economic requirements and strategy techniques to stretch the pension savings. Capable in addition counsel you on when you should begin making use of personal Security and using the income inside your retirement reports in order to avoid any horrible penalties.

Independent Investment Advisor Canada Fundamentals Explained

They may be able make it easier to ascertain what common resources tend to be right for you and demonstrate how exactly to handle while making the absolute most of opportunities. They may be a fantastic read able also allow you to see the risks and exactly what you’ll ought to do to get your targets. A practiced investment pro will help you stay on the roller coaster of investingeven when your opportunities get a dive.

They could provide you with the assistance you need to develop a strategy so you're able to ensure that your desires are carried out. Therefore can’t place an amount label regarding the reassurance that include that. Per a recent study, an average 65-year-old couple in 2022 will need about $315,000 conserved to pay for medical care prices in retirement.

Indicators on Tax Planning Canada You Need To Know

Given that we’ve reviewed what economic advisors perform, let’s dig in to the differing kinds. Here’s a great rule of thumb: All economic planners are financial advisors, although not all experts tend to be planners - https://www.blogtalkradio.com/lighthousewm. A monetary planner centers around helping folks develop plans to achieve lasting goalsthings like beginning a college investment or keeping for a down payment on a house:max_bytes(150000):strip_icc()/financial-advisor-career-information-526017_final-9c1362c7706146ada8c9173002ddee69.png)

Exactly how do you understand which economic consultant is right for you - https://www.artstation.com/user-5327267/profile? Check out actions you can take to be certain you are really choosing best individual. What now ? when you yourself have two poor options to select from? Simple! Find more options. The more solutions you really have, a lot more likely you may be to make good choice

What Does Investment Consultant Mean?

All of our Intelligent, Vestor plan can make it possible for you by showing you around five monetary analysts who are able to serve you. The good thing is, it is totally free getting connected with an advisor! And don’t forget to get to the meeting ready with a list of questions to inquire about in order to figure out if they’re a great fit.But tune in, just because an advisor is wiser as compared to average bear does not let them have the right to let you know what direction to go. Occasionally, advisors are loaded with by themselves simply because they convey more degrees than a thermometer. If an advisor begins talking-down for your requirements, it's for you personally to suggest to them the entranceway.

Understand that! It’s essential that you as well as your financial advisor (the person who it ends up getting) take the exact same page. You need an advisor that has a long-lasting investing strategysomeone who’ll motivate one to keep spending consistently whether the marketplace is up or down. investment consultant. You don’t need to work with someone who pushes you to spend money on something which’s too dangerous or you’re unpleasant with

The Main Principles Of Lighthouse Wealth Management

That combine provides you with the diversification you ought to effectively invest for all the long term. Whilst study financial advisors, you’ll most likely come across the term fiduciary task. All this work implies is any advisor you employ needs to act in a way that benefits their unique customer and not their own self-interest.Report this wiki page